Search result

During a time where consumers are looking for quick and safe ways to pay for their online services, mobile phones come to offer an easy solution that does not require the use of bank accounts, e-wallets, debit or credit cards. That solution is no other than Boku; a company that effectively processes mobile payments for online products and services.

By simply using your phone credit, you are going to be in full control of your online expenses, regardless if you want to buy a new pair of shoes or book an online course. Additionally, Boku allows casino players to pay by phone and to easily set their own deposit limits. Players will not be charged for using Boku as a deposit method. Even though this might seem as just another payment alternative for people that regularly use traditional payment methods online, it is always worth keeping in mind, that there are many people that are worried about sharing their bank or credit card details on the web.

How Does One Pay Using Boku?

Users can start using this payment method, by simply downloading and installing the Boku application found in their mobile phone's app store. Given that one's mobile operator allows for transactions via Boku, this payment service acts as a tool which uses the mobile phone holder's billing service in order to instantly draw the funds required for the finalisation of an online payment. This means that if a video game or a casino game player were to deposit funds in their gaming or casino account, those funds would be added on their phone bill at the end of the month.

Boku services can also be used by those who use prefer taking the "pay as you go" approach instead of having a fixed long-term contract with a provider. In the case of prepaid phone credit, transactions will be processed until there are no longer sufficient funds in the user's account. This means that Boku will only deduct existing funds and it will not charge the user beyond the limit of their prepaid credit. Boku users are notified when their phone number funds do not suffice for the completion of a transaction.

Is Boku a Safe Payment Method?

Boku is a payment service that is trusted and recommended by numerous online services or product providers. Apart from gaming and online casino platforms, Boku is a method used by tech giants such as Apple, Google and Microsoft. All transactions are processed instantly and safely. Its credibility as a safe payment method is backed by the fact that many businesses and services use Boku as an identity verification tool. This tool is used by banks, payment services and public authorities.

Can Boku Be Used as a Withdrawal Method?

Boku is primarily a depositing payment service, which means that it currently cannot be used as a withdrawal method. The good news though, is that websites such as online casinos will offer dozens of other withdrawal methods, which a player can easily use to withdraw their funds.

Today's businesses tend to develop advanced loyalty programs. A client gets rewards for buying a product or a service. The same happens in the banking industry. Bank purpose numerous rewards for owners of travel credit cards.

When a person opens a bank travel card he gets points as he spends. It is good to accumulate point. For many miles, you can get a big reduction on a price of an airline ticket. You can read more information about best travel rewards credit card form numerous online resources.

How to search flight options and get price reductions

To get reductions on a plane ticket you can not only keep them accumulated on your bank card. You have to choose an airline that will accept your points. There are too many airlines companies in the world, That is why people use professional websites, that compare the best flight option. They offer a fine way to evaluate flight options. Here is how you can do it:

● Enter into a system the place of your departure and final destination. You also have indicated if you have any points accumulated. Travel credit card issuer will give you such information.

● Get a flight comparison. A system will propose many flight propositions. You can get around 20 flight offers from various airlines. You will also get information on how many rewards you can redeem and how many rewards you can earn.

● You can choose an option you find relevant. You will then have a possibility to buy a ticket for a discounted price.

These are simple steps to take. Using such a comparison tool, you will have a possibility to choose the best flight option.

How to transfer your miles to a specific airline

As you spend money from a travel card, a bank gives you miles. They are calculated in points equivalent. A certain amount of points has concrete dollar equivalent. When you decide to buy a travel ticket you can transfer your reward and compensate ticket price.

To do it you have to register on websites that propose miles transfer service. In the United States of America travelers usually use Chase travel card. To collect miles from this plastic you have to use Chase Ultimate Rewards program.

After you open an account on the website you will be able to see the number of points you accumulated. You can redeem points when you find it necessary. You have to click ‘Transfer points' and choose airline miles should go to. A system will evaluate your request and calculate a final ticket price for you.

Another program that proposes to transfer points is called Starwood Preferred Guest Points. It is a unique program. It helps you to accumulate points as you make a transfer of the miles. You earn as you spend your miles.

In today's world, there are many ways to economize. Take an advantage of it. Choose a program that will help you to earn most of the miles.

![]()

Verizon has the sole right to sell the Google Pixel phones as a carrier, but T-Mobile has a deal for you that might just tempt a few of the Pixel phone owners towards committing to T-Mobile for the long run. If you have a Pixel, a subscription to T-Mobile's Unlimited One plan will earn you a bill credit of $325. Considering that it will shave off half the price from the 32GB variant of the Pixel ($649) and the price of an additional mid-range smartphone from the cost of the 32GB Pixel XL ($769), this plan already has the attention of the customers.

However, before you start getting to excited about the offer, there are a few stipulations that you must take into account. Firstly, the Unlimited One plans start at $70 per month and in spite of being touted as "unlimited," it downgrades videos to 480p resolution, as well as throttling tethering speeds. Secondly, you WON'T be receiving the entire $325 in one bill credit; rather, it will be evenly distributed over the course of 24 months, at a rate of $13.55 per credit. Finally, in order to avail this offer, you will need to sign up for it within 30 days from your Pixel's date of purchase.

Considering the insane price tags on the Pixel phones and especially the Pixel XL, will you go for this plan? More importantly, will it actually benefit you and suit your needs?

Saikat Kar (tech-enthusiast)

Recently a security research team at ThreatFabric discovered a new Android malware that could target a list of multiple apps that requires user credentials to login including social, communication, and dating apps. The malware is called Black Rock. It is a banking Trojan - derived from the code of the existing Xerxes malware that is a known strain of the LokiBot Android trojan.

However, despite being derived from a banking Trojan, the malicious code seems to have more interest in non-financial apps than the banking apps. It pretends to be a simple Google update, and ask for permission to update the apps. Though after getting into the system, it hides its icon from the app gallery and moves the bad actors while being staying in the back.

The team found this malicious code in May, but they kept working to study it. As per the analyst team, the code can do far more than just stealing your user's login information. It can save and forward the credit card information as well. Although, it may sound like a regular malware, so far, it has acquired the ability to attack 337 apps, which is significantly higher than any of the already known malicious code. "Those ‘new' targets are mostly not related to financial institutions and are overlayed to steal credit card details," the team at ThreatFabric said in a blog post.

He malware is designed in such a way that it can overlay attacks, send, spam, and steal SMS messages. It can also lock the victim app in the launcher activity. By acting as a keylogger, it can record every key being hit and could help the hacker to gather all the information he needed. Furthermore, they have found that due to its unique nature, it can deflect the usage of antivirus software such as Avast, AVG, BitDefender, Eset, Trend Micro, Kaspersky, or McAfee.

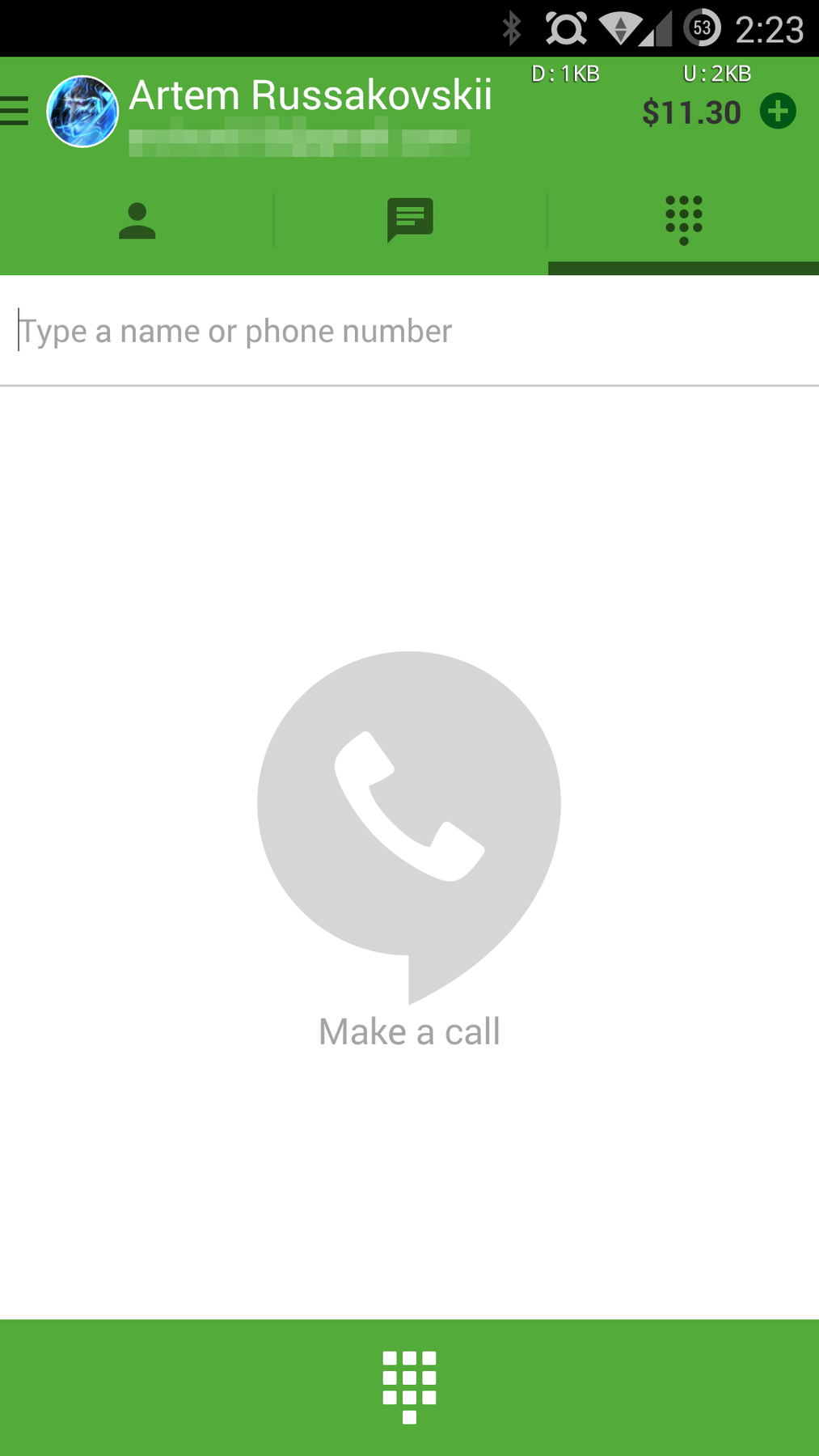

Google updated its Hangouts App to v2.4 with some minor improvements. In the New Hangouts 2.4 you will natice that if you slide over the dialer screen there is now a call credit display in the upper right corner.

You can tap the button up there to open a browser and add more money to your account as well. That displaces the clear log button to the top of the call log. Otherwise we're not seeing anything on the surface. Get the official APK from the link below right now, or wait for the update to hit your phone.

Many people are only just getting to grips with the fact we're edging closer and closer to a cashless society. But such is the pace of technology we may also be saying goodbye to our flexible friends as credit cards are being replaced by mobile payments.

It's estimated that over 47% of people in China now use mobile wallets to pay while in Norway that percentage is 42% and the UK, 24%. That's a significant proportion given it's a relatively new concept and puts the card in significant danger of extinction.

Methods of payment are becoming much less physical no matter what the industry. In stores we can now pay via our smartphones, our travel cards are hooked directly to our bank accounts and even in online gaming we can simply sync up our mobile phone account and play the best pay by mobile slots today. That means there's absolutely no need to enter card details, it is simply added to your bill at the end of the month.

These new methods are edging the more traditional formats of payment out and the new generation are certainly favouring mobile ahead of carrying around a physical wallet.

That's only going to continue. By 2022 it's estimated that $14trillion will be spent via mobile pay and it makes sense with security measures forever increasing.

Predictions are expecting that digital wallets will surpass card payments by 2021, and will even more useful ways such as phone bill charging and cryptocurrency also popular we could be completely virtual sooner than we think.

As you'd probably expect it's millenials who have adopted it the quickest. Around half of 18-34 year olds use a mobile wallet, compared to just 20% of those 65+. That will change with education though as more and more people realise it's the smarter option.

Online wallets and brands like Android Pay and Apple Pay use incredibly secure systems and technology. They don't actually use cardholder data to connect with outside payment devices, but rather technology called tokenization which essentially encrypts your data to ensure secure payment.

That's on top of a number of other safety features which make it much more security conscious than carrying around your credit card in your pocket.

This is starting to become more understood by people and whether it be mobile phone bill payments to gaming sites or using Apple Pay in a department store, the less you connect your own bank details with other networks, the less chance you have of having your data breached.

Over the next few years, mobile payment is going to continue to transform how we live our lives. Wearable tech is already allowing us to use this as a method of payment, while mobile wallets are only going to get more secure and simple for us to use.

The cashless society is almost complete. The cardless is also well and truly on the horizon.

© 2023 YouMobile Inc. All rights reserved