MediaTek's lead over Qualcomm in SoC shipments declined pointedly in Q4

MediaTek's lead over Qualcomm in SoC shipments declined pointedly in Q4

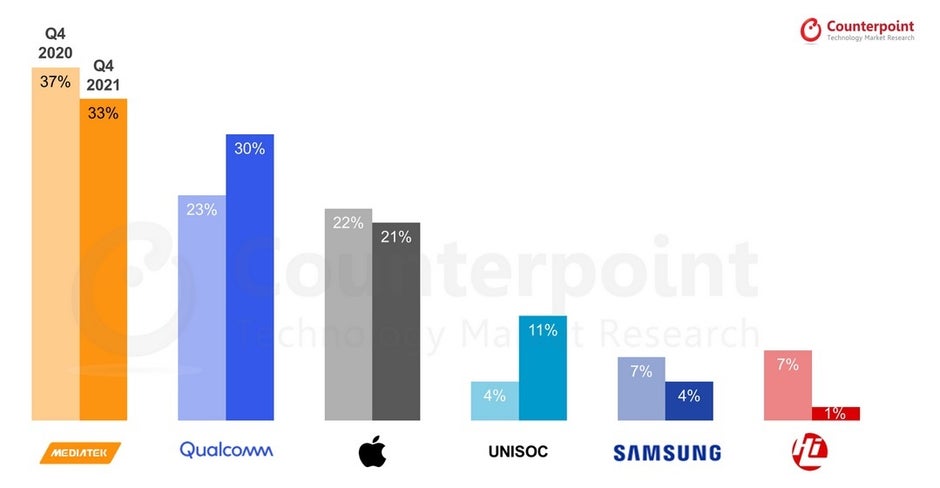

Statistical surveying firm Counterpoint has delivered its most recent report on the smartphone Applications Processor (AP) chipset market for the final quarter of 2021. During the period from October to the furthest limit of the year, the top chipset provider in the business was MediaTek which saw its lead over Qualcomm decline to only three rate focuses from 14 rate focuses the year before. By and large, AP chipset shipments rose 5% from Q4 2020 to Q4 2021.

MediaTek's lead over Qualcomm recoils significantly

MediaTek had a 33% portion of the overall industry during the last quarter of 2021 which was down from the 37% it gathered during the final quarter of 2020. Contrast said that MediaTek's shipments dropped in Q4 on the grounds that smartphone makers had been requesting a larger number of chips than required during the vast majority of the year in the event the chip lack kept them from acquiring how much parts required.

However, generally, this turned out not to be an issue and when the final quarter showed up, makers went through a stock remedy requesting less chipsets contrasted with the sum requested toward the start of 2021. The Dimensity 9000 chip assisted MediaTek with keeping its situation as the biggest transporter of chipsets to smartphone makers. Contradiction additionally refered to weighty interest for 5G handsets as a justification for MediaTek's solid appearance, and it expects one more solid year in 2022 for the organization as more customers purchase 5G phones.

Qualcomm, the San Diego-based fashioner of Snapdragon chips, saw its piece of the pie take off from 23% in Q4 of 2020 to 30% for the final quarter of 2021. This cut strongly into MediaTek's lead. Qualcomm had the option to acquire an adequate number of chips by having both TSMC and Samsung Foundry double source different chips. Late reports show that Qualcomm will get back to TSMC for the following year's 3nm Snapdragon 8 Gen 2 Applications Processor.

For set its accentuation on the organization's expensive, high-edge Snapdragon chips. Its Snapdragon 5G baseband modem chips overwhelmed that area with a 76% offer contrasted and 63% for a similar quarter during the earlier year. Contradiction credits interest for the 5G iPhone 12 and iPhone 13 lines, and those Android leaders that are furnished with Snapdragon 5G modems.

Apple's portion in the smartphone chipset world dropped by 1% from the final quarter of 2020 to a similar quarter a year ago. Contradiction says that Apple had a 22% cut of the smartphone chipset pie in 2020 which declined to 20% last year. Remember that all of the chipsets planned by Apple and worked by TSMC and Samsung end up utilized by Apple for its own items.

Qualcomm overwhelms the 5G baseband modem market

Unisoc, a less notable chip creator, saw its Q4 portion of the overall industry ascend from 4% to 11% year-over-year. That organization gives chipsets to smartphone producers like Honor, Realme, Motorola, ZTE, Samsung, and others. Discussing Sammy, the Exynos chipset line saw its portion of the smartphone chipset market decline from 7% in Q4 2020 to 4% for Q4 2021. Contrast pins the decay on Samsung's developing utilization of MediaTek and Qualcomm chips for its mid-range 4G and 5G models.

Because of the proceeding with U.S. limitations put on Huawei, the stock of Huawei's HiSilicon Kirin chips are completely depleted. A change to U.S. send out rules made in 2020 forestalls foundries utilizing American innovation from delivery chips to Huawei, regardless of whether they are Huawei's own Kirin chipsets.

Subsequently, Huawei has been compelled to utilize 4G Qualcomm Snapdragon chips for a portion of its leader phones. This was reflected in Counterpoint's information which shows Huawei's HiSilicon unit with a 7% portion of AP chipset shipments in the final quarter of 2020 dropping to only 1% during the final quarter of 2021.

As we recently referenced, Qualcomm has a tremendous lead in modem chip shipments with a 76% offer. That is trailed by MediaTek which saw its portion ascend in this area from 17% in Q4 2020 to 18% in Q4 of 2021. Samsung's modem chips went from 5% of the market to 4% from the last quarter of 2020 to the last quarter of 2021. Apple could enter this market when one year from now which will undoubtedly be terrible information for Qualcomm.

© 2023 YouMobile Inc. All rights reserved