Search result

The Smartphone has never been more popular. In the modern age, our phones have become an extension of self, we use them constantly to update, navigate and traverse the modern landscape. We check the traffic, monitor the weather and use GPS to make our way around. According to an article published in Tech World there are up to five billion cell phone users across the globe - that's a lot of handsets. Because most modern smartphones are so delicate, most people choose to protect their phone with a case. The trouble is most of these cases are made from environmentally detrimental materials. With over a billion new handsets sold every year, that adds up to a big pile of waste heading to the landfill or even worse, the ocean.

Thankfully, there are better options out there. Many proactive companies have begun to offer greener, earth-friendly phone accessories. We've picked our two favourites and outlined the benefits of their products.

In terms of protection, this case can hold its own with traditional plastic phone cases. Although, this case does not have an official drop rating yet, the company promises satisfaction or your money back. Finally, the most important feature: when you're retiring your phone, simply toss this case onto the compost heap and let nature take its course. You can shop the eco-friendly phone case range here at CaseFace.

These are by no means the only options for a greener case. More and more companies are choosing to offer most sustainable options to their customers and choosing such options can have a dramatic effect on the environment. So, when shopping for your next case, consider going green.

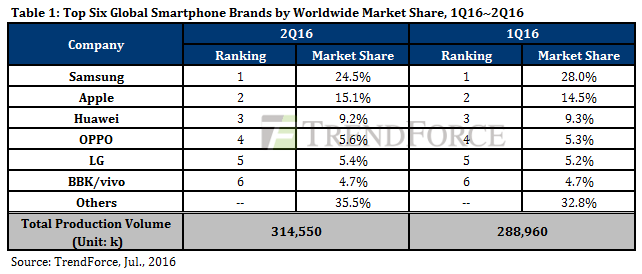

We now have the official reports from market research firm TrendForce on our hands and it reveals the smartphone food chain around the world, based on the second quarter of 2016. The first thing that we noticed is that Samsung's plans for global domination continue to be a success with a market share of 24.5% internationally! Apple is in the second place of course with 15.1%, but the huge difference between the two giants does tell a story. Chinese OEM Huawei comes in at the third spot with 9.2% market share, leaving behind the likes of LG (5.4%) and Oppo (5.6%).

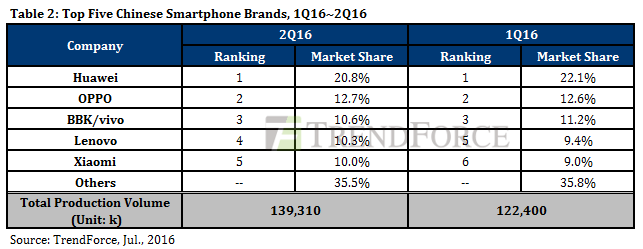

China is the world's biggest market for smartphones and it is being led by none other Huawei once again, with an amazing 20.8% of the total market share. Oppo (12.7%), Vivo (10.6%), Lenovo (10.3%) and Xiaomi (10%) followed respectively from there on. As you can see, the competition is really tight from the third spot onwards with virtually nothing separating the competitors from each other. In addition to Samsung's continuing domination over the global smartphone market, one should notice that the Chinese manufacturers are rapidly rising with each passing quarter, especially Huawei.

Saikat Kar (tech-enthusiast)

The Xiaomi Mi Mix is currently the most talked about smartphone in the world, thanks to the brilliant design it brings to the plate with a near bezel-less display which boasts of a screen-to-body ratio of 91.3%. Nevertheless, we will surely see a lot more of the same design from other manufacturers next year, so here's a list of the best bezel-less smartphones that are coming in the near future.

Samsung Galaxy S8

There were rumors, but after a hint by Samsung senior engineer Park Won-sang, it's almost a certainty that at least one version of the S8 is going to feature an edge-to-edge Super AMOLED display with more than 90% screen-to-body ratio.

Apple iPhone 8

If we take a report by Barclays Research seriously, then Apple is about to mark the 10th anniversary of the iPhone with a curved edge-to-edge OLED display.

Huawei "Quad-Edge screen"

We don't know the name of the phone yet, but what we do know is that a Huawei phone is coming with an all-screen display that's curved on the four corners and it's being termed as the "Quad-Edge screen."

Meizu Pro 7

If the rumors surrounding the Meizu Pro 7 turn out to be true, then it's going to sport a 2160 x 1080 AMOLED display, with a screen-to-body ratio of more than 96%!

What do you think about the borderless design? Are they the future of smartphone displays, or just a temporary fad?

Saikat Kar (tech-enthusiast)

Google says the Android platform is more secure than ever, although there has been an increase in the number of potentially harmful applications (PHAs). In its latest Android Security & Privacy Year in Review report for 2018, Google says threats continue to be observed in apps that are pre-installed or are packaged in over-the-air (OTA) updates.

Android security has been a consistently hot topic through the history of the platform. Google's OS has often suffered from breaches in security, mostly delivered to smartphones through apps and browsers. Needless to say, security problems can cause problems when you are trying to enjoy bonuscode.my on your device browser or performance simple everyday tasks.

Image credit: pixabay.com

Google has often defended Android by saying the operating system is completely secure in its stock form. The problem is OEMs take the platform and add their own services and UI touches to it, often compromising Google's own security mitigations. This problem is made worse by many OEMs delaying security patches and system updates for months.

Over the last five years, Google has published its Android Security & Privacy Year in Review, which details the threats and vulnerabilities that have impacted the OS. In 2018, the company says a rise in PHAs caused the biggest cause for concern.

"Malicious actors increased their efforts to embed PHAs into the supply chain using two main entry points: new devices sold with pre-installed PHAs and over the air (OTA) updates that bundle legitimate system updates with PHAs," wrote Google in its Android Security and Privacy Year in Review 2018.

Despite a rise in PHAs, Google says the number of those threatening applications landing on Android devices actually declined by 20 percent last year. Indeed, just 0.08 percent of all Android devices were affected by PHAs during 2018.

While this is impressive, it is data that should be taken with a pinch of salt. The problem with Google's annual report is that it only charts applications that were downloaded from the Google Play Store. Sure, most apps end up on Android devices via the store, but there are other stores and places users can download apps from. Google does not keep data on PHAs from these less secure services.

It is also worth noting that Android is now on over 2 billion devices around the world. That means 0.08 percent of devices Google says were affected by PHAs in 2018 amounts to over 1.6 million smartphones affected, a pretty large number.

In terms of specific regions, Google says India has shown a security improvement on Android devices. In the platform's "biggest market", security threats and exploits are frequent, but improvements are being made in India.

For example, Indian Android devices became 35 percent cleaner throughout 2018 compared to 2017, with only 0.65 percent of handsets affected by PHAs at a single time. In fact, Google says Indonesia is now the leading nation in terms of PHA spread.

Despite steps in the right direction in India, the country remains the most likely to receive Android trojan attacks, with 22.4 percent of all global cases.

From the creation of the world wide web to where the digital world is at now, the transformation has been incredible. The accessibility of technology has enhanced the digitalization of payment with finance no longer restricted to cash and the cheque book.

The digitalization of payment can be seen most pertinently in the rise of online gambling. With digital payments now completing transactions in seconds, the global online gambling market is expected to hit $94 billion of value by 2024 - double the current market size. A quick financial transaction for the best sports betting usa sites that are available at the touch of a fingertip from the comfort of your own home has ensured that the number of online bettors continues to ascend.

Indeed, an Online Casino Reports study in 2016 found that leading online casino and sports betting sites like www.oddshunter.ca were receiving almost 2000 visitors per day with hard cash no longer an issue.

This infiltration of technology and digital payments into everyday life has increased the likelihood of a cashless world as digital takes over the world of finance. But, just how has it done this?

The original and modern internets

Although stating the obvious, digital payments can only occur when there is an internet connection. It was 1969 and the creation of ARPANET (Advanced Research Projects Agency Network) that set the ball rolling for the modern internet. It was the first time that the TCP/IP protocol suite had been used.

Though revolutionary, it hardly set the world alight and so it was up to Sir Tim Berners-Lee to develop the World Wide Web twenty years later. Hyperlinks were merged with web pages and sites that made digital payments realistic.

Online payments with eservices

Online payment services began with an important if troublesome development in 1994. The Stanford Federal Credit Union developed an online internet banking system - the first of its kind - yet it failed to hit the mark with the ordinary man in the street. Specific knowledge of data transfer protocol was needed, making the service difficult to use.

The 1990s, however, played an essential role in the rise of epayments. The likes of Millicent, ECash and CyberCoin began to provide ecash, digital tokens or tokens as cash alternatives in an attempt to digitalize payment. Ecommerce mogul Jeff Bezos created Amazon in 1994 too.

Paypal and Apple Pay

Now a frontrunner in epayment, Paypal has only been around since 1999. It took the service a while to get going, but once ebay users latched on to its ease of payment methods, Paypal usage rocketed. Different currencies and methods to reduce fraud have reinforced Paypal's superb reputation, and, as a result of its enormous growth, the service was given an EU banking license in 2007.

Even then though, digital payment is forever adapting and morphing into new and exciting projects. Apple Pay, launched in autumn 2014, allows iPhone users to scan their fingerprint to purchase goods. Google and Amazon have also made huge strides by improving wallet functionality and the ability to gamble online.

Where the future of payment lies

It's often described as a complicated service, but Bitcoin seems to be where digital payment is heading. Its creation in 2009 saw something important finally be realized: the success of a decentralized finance currency doubling spending in the absence of a central server or trusted body. Bitcoin thus took epayment into previously uncharted territory, and can certainly be considered as the future of digital payment.

Digital payments have come a long way since the Stanford Federal Credit Union's attempts to found an online banking system in the early 1990s. But, the development of the modern internet and the consistent evolution of epayment services from Paypal to Apple Pay to now cryptocurrency, means a cashless society is no longer a fantasy. In fact, if bitcoin and the like continue their rapid growth, it could be a lot sooner than what most people think.

© 2023 YouMobile Inc. All rights reserved